The Canadian Imperial Bank of Commerce (CIBC) is one of Canada’s oldest and most reputable financial institutions. The headquarters is located in Toronto, ON, Canada, but with branches in other cities and countries.

Written by: Piggyy

CIBC Personal Loan

CIBC Personal Car Loan

CIBC RRSP Maximizer Loan

Bank services

The Canadian Imperial Bank of Commerce was created on June 1, 1961, by merging two chartered banks. The Canadian Bank of Commerce, founded in 1867, and The Imperial Bank of Canada, founded in 1875. This merger is the largest one that has ever gone down in the history of Canada, which is not very surprising, considering how big CIBC has turned out to be.

CIBC is more than just a bank where money is being handled; it also has a history of helping people, communities, and companies in Canada and all around the world prosper and grow to reach their full potential.

Over the years, CIBC has absorbed many security firms like the American securities firm Oppenheimer & Co. Inc and some smaller banks. The bank is part of the Depository Credit Intermediation industry and has an impressive number of over 44,000 total employees across all its branches.

CIBC generates close to $14 billion in sales, and the bank is driven by business cultures relying on common values: Teamwork, Trust, and Accountability.

It is located at 199 Bay Street, Commerce Court Toronto, ON, CA, M5L 1A2.

CIBC observed federal holidays. To be on the safe side, you should call the branch you want to visit before you go to know if they are available.

The CIBC Bank customer service email address is [email protected]

CIBC Ombudsman: [email protected]

Business email address: [email protected]

The Canadian Imperial Bank of Commerce has different numbers for specific purposes. See below:

CIBC bank customer service: 1 800 465 2422

CIBC credit card services: 1 800 465 4653

CIBC media advisory: 1800 663 4575

For general banking questions:

English: 1 800 465 2422

French: 1 888 337 2422

Cantonese: 1 888 898 2828

Mandarin: 1 888 298 8822

TTY: 1 877 331 3338

Digital banking: 1 877 448 6500

Mobile banking: 1 877 433 1902

Personal loan: 1 866 525 8622

Travel assistance: 1 800 848 8454

CIBC Bank USA: 1 312 564 1378

Investor’s Edge: 1 800 567 3343

Everyday banking: 1 888 872 2422

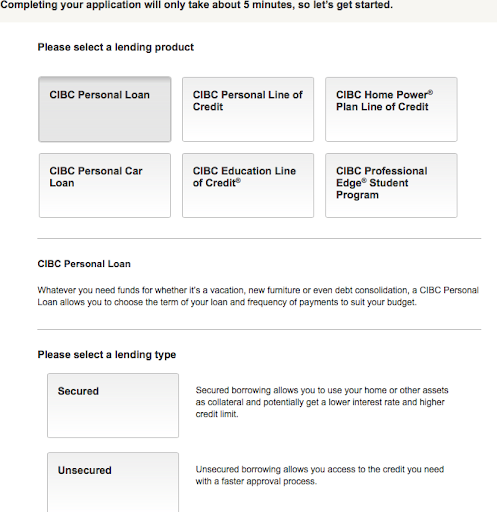

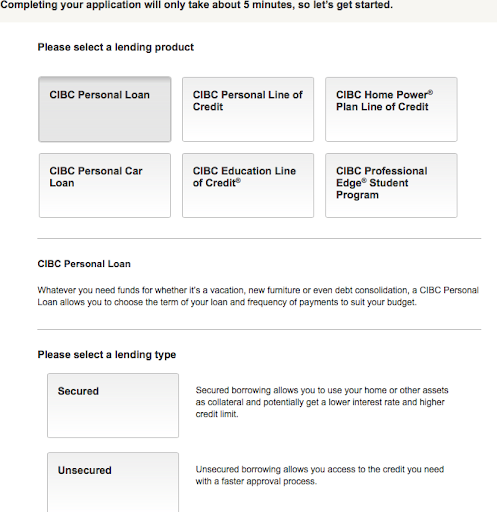

CIBC offers three types of loans to help you achieve your financial goals CIBC offers personal loans, car loans, and RRSP loans to maximize your retirement savings. You’ll find great interest rates and the perfect payment plan to work with your budget. Keep reading to find out about the types of loans CIBC offers.

CIBC personal loans are available for a wide variety of purposes. You can use a CIBC personal loan to consolidate debts, purchase something you need or want, pay for a vacation or cover an upcoming expense like home repairs or renovations.

If you apply for this loan online, you’ll need to sign all the paperwork in person at a banking center.

CIBC car loans are available to help you buy that vehicle you’ve always wanted, whether used or new. CIBC car loans are available to Canadian citizens and to newcomers who’ve been in Canada for less than five years. Special offers are available for the purchase of green vehicles.

If you apply for this loan online, you’ll need to sign all the paperwork in person at a banking center.

At CIBC, you’ll find a great way to maximize your retirement savings. The earlier you start saving for retirement, the better. With the CIBC RRSP Maximizer Loan, you can have the funds you need to make your maximum RRSP contributions or top-up any unused contribution room from previous years. Using the CIBC RRSP Maximizer Loan will help you take advantage of tax-deferred growth within your RRSP- you might even get a tax refund. Loan limits range from $1,000 to $50,000, making this a great option to fund your RRSP whether you need a little or a lot.

The Canadian Imperial Bank of Commerce offers many wonderful products to its customers. The services you can get in this bank are:

CIBC is that bank that always delivers top-tier shareholder returns and superior client experience while still maintaining strong, durable financial strength. This bank focuses on significant client segments to accelerate earnings. CIBC can be used by any Canadian or individual worldwide that is the age of majority in their province.

CIBC has some wonderful offers going on right now; some of them are:

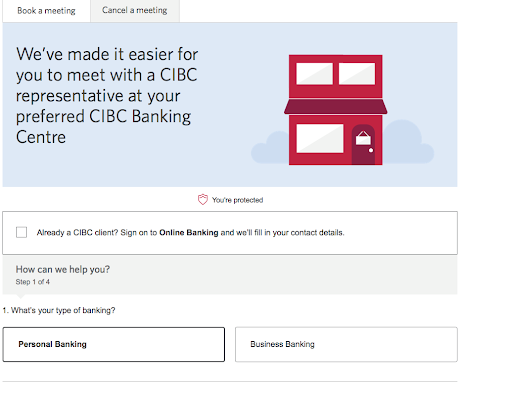

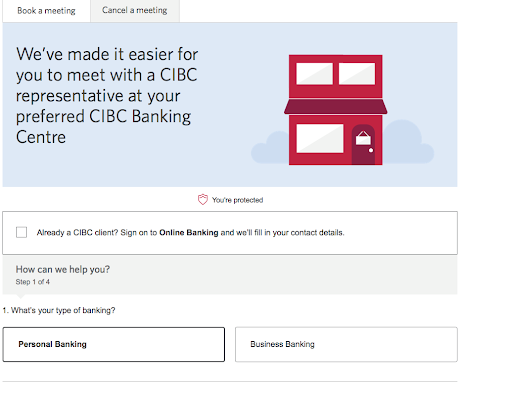

Choose a method to apply for a personal loan or a car loan.

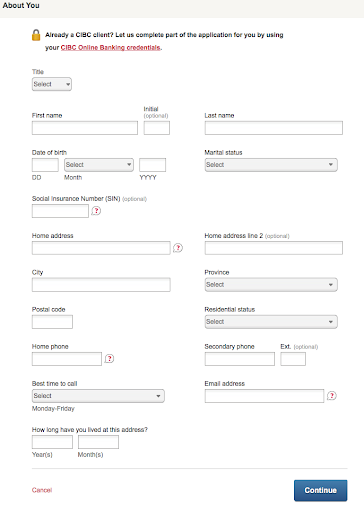

If you apply online, you will be asked to fill in the information on the following screen.

After you have made your selections, fill out your personal information on the next screen.

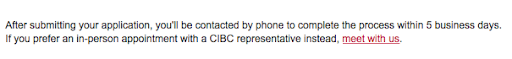

Once you finish the process, you’ll be asked to meet at a branch within five days.

Book an appointment to complete your application.

The Canadian Imperial Bank of Commerce is one of the leading banks in North America, especially in Canada. You can be proud of being a member of this bank.

CIBC was named the Best Bank for Cash Management in North America and Canada’s Best Treasury and Cash Management Bank. It is a testament to its strong endorsement for a client-focused approach and its good job of delivering the best services to clients on both sides of the border.

If you are a Canadian looking to open a bank where you can perform safe, secure, and swift transactions, the Canadian Imperial Bank of Commerce is the one for you.

Table of Contents

Table of Contents