Company Information

24Cash gives borrowers the option to apply online, by phone, by SMS, or by fax. Online borrowers can sign using an e-signature. Applications can be approved and funded the same day or the following day, depending on what time 24Cash receives the application.

Main Office Address

88 Queens Quay West, Suite 2500, Toronto, ON, M5J 0B8

- Email: [email protected]

- Phone: 1-866-646-4769

- SMS: 1-866-647-5330

Business Hours

- Monday to Thursday: 8:30 a.m. to 5:30 p.m. (Eastern Standard Time)

- Friday: 8:30 a.m. to 4:30 p.m. (Eastern Standard Time)

- Monday to Thursday: 5:30 a.m. to 2:30 p.m. (Pacific Time)

- Friday: 5:30 a.m. to 1:30 p.m. (Pacific Time)

Types of loans offered

24Cash offers borrowers three types of loans. They are all small loans that have a short repayment period. The first is a bad credit loan, the second is a payday loan alternative, and the third is a no credit check loan. All loans have the same application process, limits, interest rates, and borrowing requirements.

Bad Credit Loans

Let’s face it-not everybody has a great credit rating. Many traditional lenders won’t consider lending money to people who have had credit problems. 24Cash believes in giving borrowers a second chance. A low credit score won’t affect your ability to borrow. Bad credit loans at 24Cash are easy to apply for, and you can have the loan advanced the same day or the following business day.

Payday Loans Alternative

Payday loans are short-term loans based on a borrower’s paycheque. Borrowers sometimes have unexpected expenses or may have a problem with cash flow. A payday loan allows borrowers to borrow up to the limit of their paycheque. However, the loan is due in full when the borrower is paid again. This can cause problems for some people since the entire loan amount is taken from the borrower’s paycheque in one payment.

A payday alternative loan can make it easier for borrowers to take a small loan and repay it. This loan can be more than your paycheque, which, for some borrowers, can be helpful to get them through a financially difficult time. These loans are different from a traditional payday loan because you can have from 90-150 days to repay them. The more extended repayment period can give the borrower peace of mind. In addition, they have the option to repay the loan on a more manageable schedule instead of having all of their next paycheque taken to repay a loan.

No Credit Check Loan

Traditional lenders can decline loan applications if borrowers have no credit history, no Canadian credit history, or poor credit history. No Credit Check Loans at 24Cash are loans funded without a credit check. Having a poor credit rating or no credit rating will not be a factor in being approved for a loan with 24Cash. Because there’s no credit check, there’s also no impact on your credit score. A hard check on your credit score can reduce your credit score, which can be a problem for some borrowers.

How 24Cash loans work

24Cash loans are available in the provinces of British Columbia, Alberta, Ontario, New Brunswick, and Nova Scotia. The loans are easy to apply for and can be approved the same day or the next business day. Borrowers can apply online at 24Cash.ca or by phone. No paper documents are needed.

The approval process can take as little as one hour. If 24Cash receives your request by 1:30 p.m. EST and it’s approved, you can get the money deposited to your account the same day. Loan requests received and approved after 1:30 p.m. EST will be funded and deposited to your account the next business day after you have signed the required documents. The last step is to make your payments. The payment schedule allows you to take from 90 to 150 days to repay your loan. You can also renew your loan if you need to when the balance owing is below $150.00

How to qualify

To be approved for a 24Cash loan, you must:

- Be 18 years of age or older

- Be a Canadian citizen

- Have been employed for the last three months and have a steady job

- Have a short-term debt ratio that is low

- Cannot plan to declare bankruptcy or have a bankruptcy that’s not discharged

- Have an income of at least $1200 monthly

- Have a Canadian bank account that’s been open for at least three months and can receive direct deposits

What is not required:

- A credit check

- Any paperwork or documents

- Signing in person

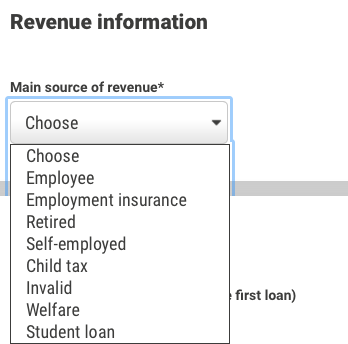

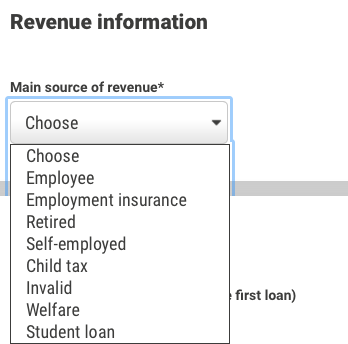

24Cash does not accept the following types of income for qualification purposes:

- Income from self-employment

- Private pension income

- Money received from student loans

- Disability income

- Welfare

- The child tax credit

- Retirement savings (RRSP/RRIF)

24Cash offers a quick and straightforward application process and approval, but borrowers can still be declined under some circumstances. Borrowers might not get an approval if:

- The information they provided online isn’t correct

- They don’t have a stable job

- They have a bankruptcy that hasn’t been discharged

- Their liquidity ratio is poor

- They have a lot of insufficient funds or other charges going through their bank account

- There can be other reasons, but these are the most common ones.

Loan limits, rates, and fees

Limits vary depending on if the borrower has previously borrowed from 24Cash or not. Loan amounts apply to all loans offered by 24Cash: Bad credit, payday loans alternative, and no credit check loans.

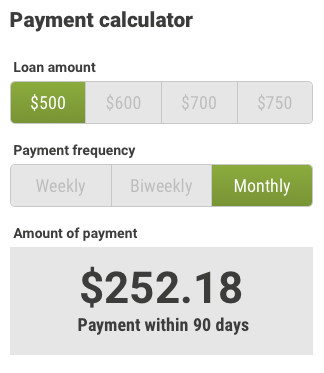

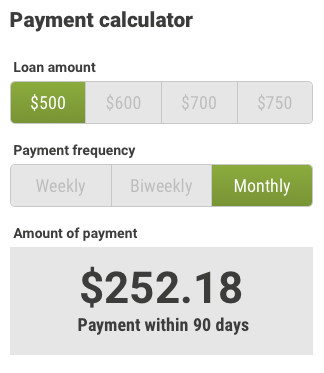

The first loan amount for a new borrower is capped at $500. The first renewal has a maximum limit of $600. The maximum limit of a second renewal is $750. Third and fourth renewals have a maximum limit of $850. You can apply for renewal once your limit is less than $150.

The annual interest rate on 24Cash loans is approximately 26%. Loans are to be repaid within 90 to 150 days, and the monthly interest rate works out to about 2.17%. There is also a broker fee on the loans. An example of the costs of a $500 loan repaid within 90 days is:

A $500 loan repaid in three monthly installments over 90 days will cost $756.54.

Other fees that borrowers might have are:

- $40 if a payment is returned for insufficient funds

- $25 fee to delay a payment

- Additional interest if the borrower doesn’t repay the loan within the required time period

Loan repayments

Borrowers can repay their 24Cash loan monthly, weekly or biweekly. Often, people arrange the loan repayment schedule to match their pay schedule. In addition, payments can be made as a direct withdrawal from the borrower’s bank account or electronic transfer to 24Cash.

Why chose 24Cash

24Cash specializes in lending small amounts to people who may be facing an urgent situation but have been declined by traditional lenders. In addition, they offer a convenient loan solution for people who need access to short-term funds. Borrowers who have a poor credit history, no credit history, or need funds quickly can apply online or by phone with 24Cash.

People in urgent need of funds or who don’t qualify for credit at traditional lenders can apply for a loan at 24Cash. Loans that are approved are funded quickly, and borrowers are given 90 to 150 days to repay the amount borrowed, depending on the loan type. Borrowers can apply to renew their loan once the balance falls below $150 and can qualify for additional funds when they renew the loan.

Borrowers can choose how they would like to apply for a loan. You can apply online, over the phone, by SMS, or, for those who prefer a more traditional application process, email or fax. Approvals for loan requests submitted by email or fax may take longer to evaluate, and email and fax are not as confidential as the instant verification process.

How to sign up

By phone:

If you want to apply by phone or need help filling out the online form, call:

1-866-646-4769

By SMS:

1-866-647-5330

By email:

Online:

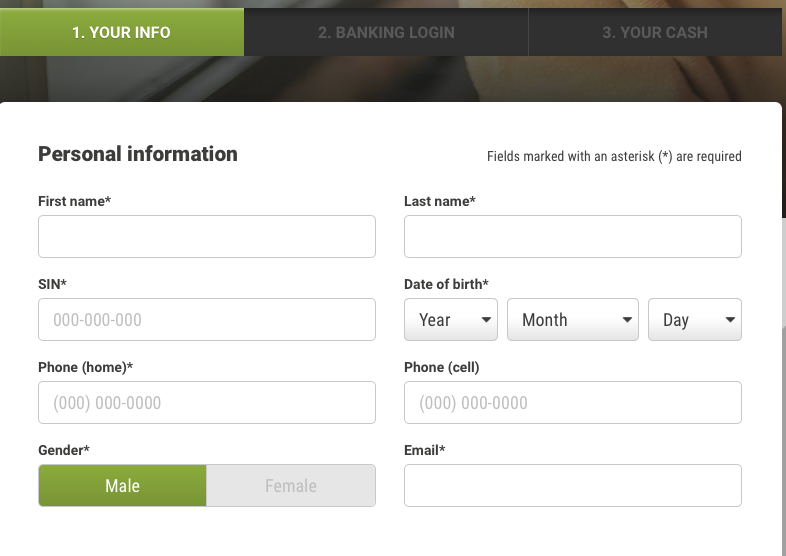

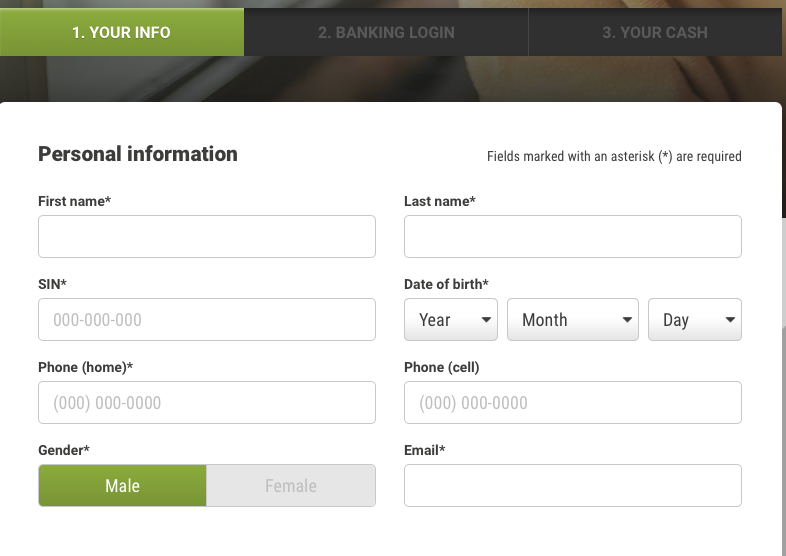

Fill out your personal information including your first and last name, Social Insurance Number, home phone number, cell phone number, date of birth, gender and email address.

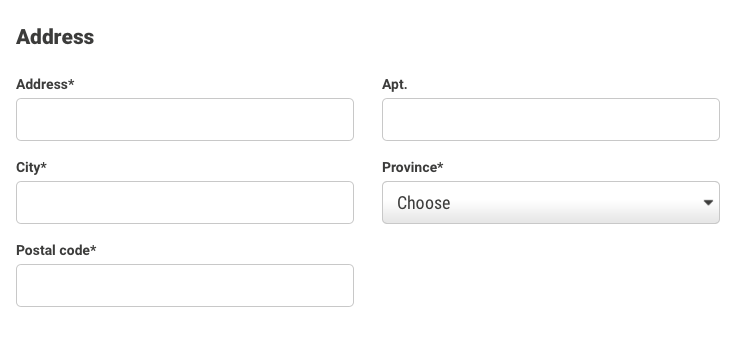

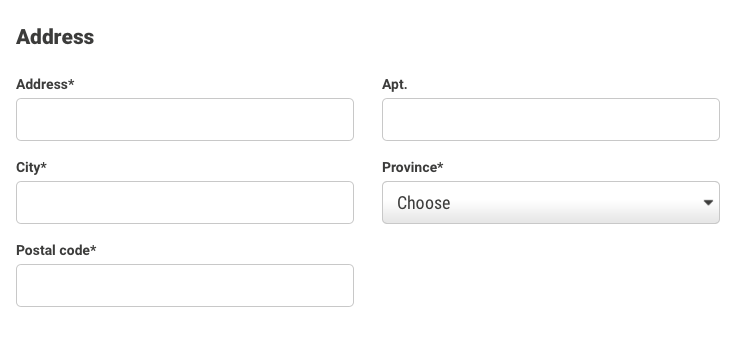

Provide your address, apartment number (if there is one), city, province and postal code.

Select your source of revenue from the drop-down list.

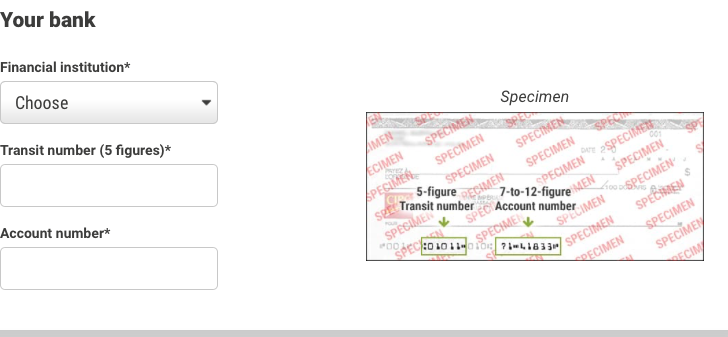

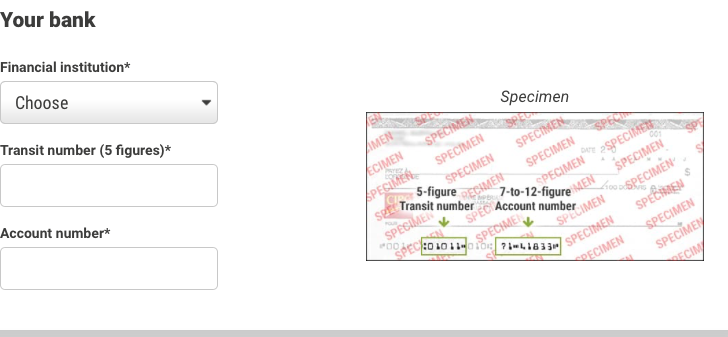

Input your bank information including the three-digit institution number, the five-digit transit number and the 7 to 12 digit account number.

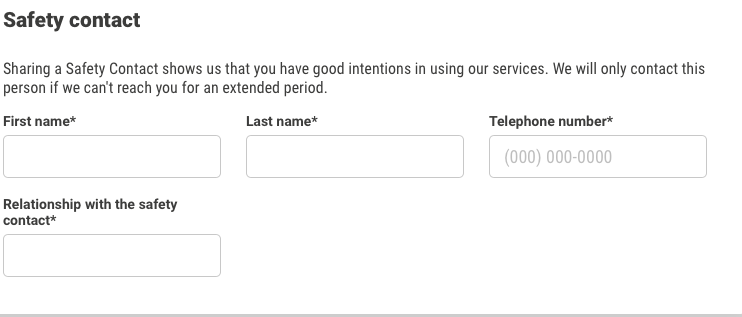

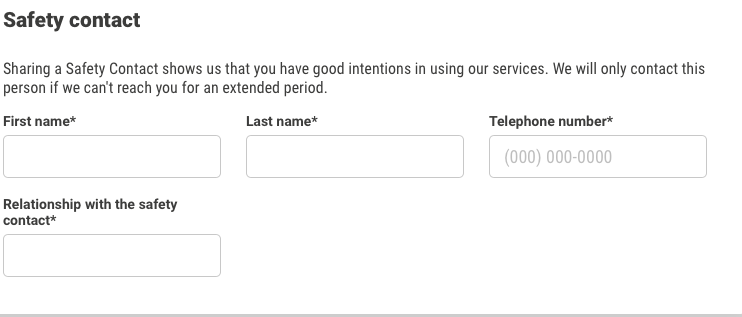

Fill in the first and last name, phone number and relationship of a safety contact. This information is used if 24Cash needs to contact you but cannot reach you.

Review the information that you have provided and, if it is correct, check the confirmation square and click “apply now.”

You will receive a reply to your credit request within about an hour.

Frequently asked questions

How is my information kept secure?

What if I am approved but I change my mind?

What happens if I can’t make a payment?

What is the maximum borrowing limit at 24Cash?

How do I sign documents if the service is paperless?

Why was my application declined?

How do I get the money?

Conclusion

24Cash is a good option for people who need cash quickly, who may have a poor credit rating or who would like to have more time to repay a loan than a payday loan offers. The loan rates and fees are higher than what you may find at a traditional lender, but they are often lower than the rates at payday loan companies.

The application process is straightforward and you can be approved within an hour. You can have access to the funds the same day or the next business day, which is helpful for people who have an emergency.

24Cash advises that their loan rates are higher than many banking options such as a credit card or overdraft protection. Therefore, borrowers need to be wise when choosing 24Cash as a loan provider so they don’t end up with debt they can’t repay.